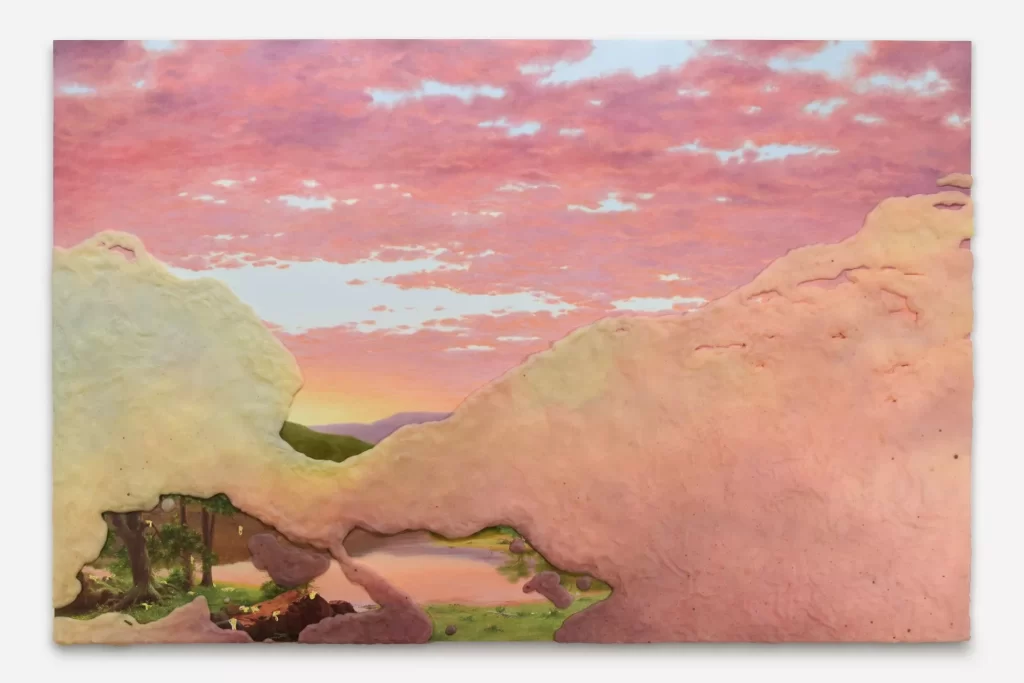

Lê Phổ (1907 – 2001). La famille dans le jardin. Circa 1938. Ink and gouache on silk. 91.3×61.5 cm, 36×24 ¼ in. Source of the image: Sotheby’s. Epitomising Lê Phổ’s technical skill and vivid sense of imagination, La famille dans le jardin belongs to the pinnacle of Lê Phổ’s oeuvre as well as the overarching stylistic epoch of Vietnamese modernism. Painted in 1938, La famille dans le jardin is the second largest figurative work in this medium by the artist to appear in the auction market. Before coming to Sotheby’s 50th anniversary auctions in Asia this past April, the painting belonged to the owner who acquired it from Christie’s 1999 South East Asian Pictures auction, which took place in Singapore on 28 March 1999, when it was estimated at 35,000 – 45,000 SGD, sold for 74,750 SGD. Appearing on Sotheby’s block, the painting earned 18,600,000 HKD, about 54 times its auction result in 1999. Source: Sotheby’s, Christie’s, Macrotrends LLC, Pound Sterling Live.

For centuries, philosophers have waxed and waned about the value of art. While we can’t resolve their debates, we can explain how art is practically valued in the market. Contrary to popular myth, the industry has a recognised and rigorous system for determining the value of fine art.

This system forms the basis of valuations, which collectors of all kinds employ for personal and business purposes. In fact, for many collectors, valuations represent another form of care; just as expert framing protects a work from sun damage, valuations verify a work’s position in the market. How? Well, if you’ve ever wondered exactly what goes into valuing a work of art, then read on.

The Different Kinds of Valuations

Three are three kinds of fine art valuation: Replacement for New Value, Fair Market Value and Market Cash Value.

Say a fire strikes your house and destroys your fine art collection. If you have home contents insurance, your claim will be based in the Replacement for New Value approach. This approach considers the cost of replacing the pre-existing artwork with an equal work of art in an open and current market. Think of it as the price of a work of art equal to the one lost.

The Fair Market Value asks: what would a willing buyer pay a seller for a work of art, granted both parties have the relevant facts? Think of it as what is reasonable to ask for the work, if you were to resell it in the open and current market. Importantly, this approach is theoretical – meaning the Fair Market Value isn’t a question of how much a work would actually sell for, but rather one of how much it ought to sell for. This method is most useful for estate and tax asset validation purposes.

Market Cash Value is the Fair Market Value of an artwork, minus the selling costs. Think of it as how much you would pocket if you were to resell the work in the open and current market. This approach is pertinent in cases of divorce or partnership dissolution.

Considering the Work of Art Itself

While a valuer considers the market, valuations begin and end with the work of art itself. In order to complete any kind of valuation, the valuer must consider: where does this work art come from, who made it and what kind of work is it?

Where did your work of art come from?

Works of art derive from either the Primary, or Secondary market. The Primary Market describes the marketplace a work enters for the first time. When this happens, its value is contingent upon its gallery, which may be shaped by the Gallery Dealer, Art Consultant, Alpha Collector and Curatorial Staff.

A work enters the Secondary Market when it is sold again. Here, supply, demand and the level of marketing attached to the work affect its value.

Who made your work of art?

In the art world, we like to separate artists into three tiers: Emerging, Mid-Career and Established. Doing so, can help regulate the value of works and inform fair valuations.

Like tadpoles, Emerging Artists are fresh to the art world. Typically, they have graduated from some form of artistic study, have a small body of work and have honed their practise. While they may have exhibited in group shows or artist run spaces, it is unlikely they have sold work through an auction. These artists are at the cusp of their careers.

As the name would suggest Mid-Career Artists are in the middle of their artistic journey. By now, they have an independent body of work with at least regional institutional recognition. They may have also sold through auction and will have exhibited solo many times.

Established Artists are considered ‘blue chip’ in the art market. Living or dead, they boast a large body of work, national or international recognition and demonstrate an advanced level of achievement. Think Charles Blackman.

What about other valuation factors?

Knowing from which market and artist your work of art derives sets the scene for valuations. Values will also however, consider six additional factors when developing their report: quality, rarity, condition, provenance, exhibition and publication history, and size.

Quality is that ‘je ne sais quoi’. It refers to those intangible traits that inspire people to stand in front of a painting for hours on end, head tilted. Sometimes quality arises from the formal traits of a work, such as the artist’s technical execution and composition or else from the poignancy, uniqueness or pertinence of its subject.

Rarity is self explanatory. If a work is especially rare, it is more desirable and those, probably more valuable.

If a work of art is damaged, fading or punctured, its condition is affected. Ideally, your work of art will be in stellar condition.

Provenance is an interesting aspect of valuing art. While objects are typically more valuable if new, artworks operate a little differently. If a work of art has passed between notable collectors or celebrities, it becomes more valuable. In this way, a work’s provenance or history of ownership can prove influential.

Similar to provenance, is the Exhibition and Publication History of a work of art. If a work has been exhibited or published anywhere significant, its value can strengthen.

Finally, the value of a work of art can be influenced by its size. If an object is large, it may be more valuable – but this rule isn’t hard and fast. A tiny work by John Olsen will almost always be more valuable than a large canvas by an emerging artist. Similarly, if a small work is high-quality or quintessential to an artist’s oeuvre, it may be more valuable than a big poor quality or obscure work.

Source: Art and Collectors