Sophie Neuendorf, Vice President of Artnet and LUX Senior Contributing Editor, turns her insider’s eye to emerging trends to bring us her art-world predictions for 2024

1. Online fine art sales will take up more market share

According to financial services company UBS, online fine-art sales made up 16 per cent of the $68 billion global fine-art market in 2022, up from six per cent in 2019. With the rise of a new tech-savvy generation and the desire for digital solutions and experiences, I predict online sales will continue to rise.

2. All eyes will be on Christie’s and Sotheby’s

It’s no secret that the art market has been volatile recently. Sotheby’s failed to consign several hot single-owner sales and Christie’s had the Fineberg sale disaster. But with a summer Sotheby’s sale that included a rare Klimt portrait with an estimate of $80 million and Christie’s total sales outperforming Sotheby’s for the first half of 2023, the fightback is on. Will Christie’s finally emerge as the art-world auction powerhouse? The stage is set for 2024.

3. There will be a consolidation of the market

A plethora of art-related companies have surfaced over the past few years. The question is, with online experiences and transactions increasing, which companies will take the lead in this hot segment? I predict that only a few companies will survive and take the lead in the market, especially because of socioeconomic pressures, and this will become apparent during 2024.

4. Art and fashion collaborations will expand

I recently spoke to a friend who works in one of the major haute fashion houses about the rapidly increasing collaborations in art and fashion. These are fruitful creative marriages with benefits on both sides. While the fashion industry gains depth and seriousness, fine art can gain new potential collectors. There have been controversies, such as the concerns over Louis Vuitton’s 2023 collaboration with Yayoi Kusama. At Saint Laurent, however, Creative Director Anthony Vaccarello is doing a remarkable job in supporting established and emerging artists, just like Yves Saint Laurent himself. There’s an exhibition space at the Rive Droite site and global pop-up shows including Sho Shibuya at Art Basel Miami Beach.

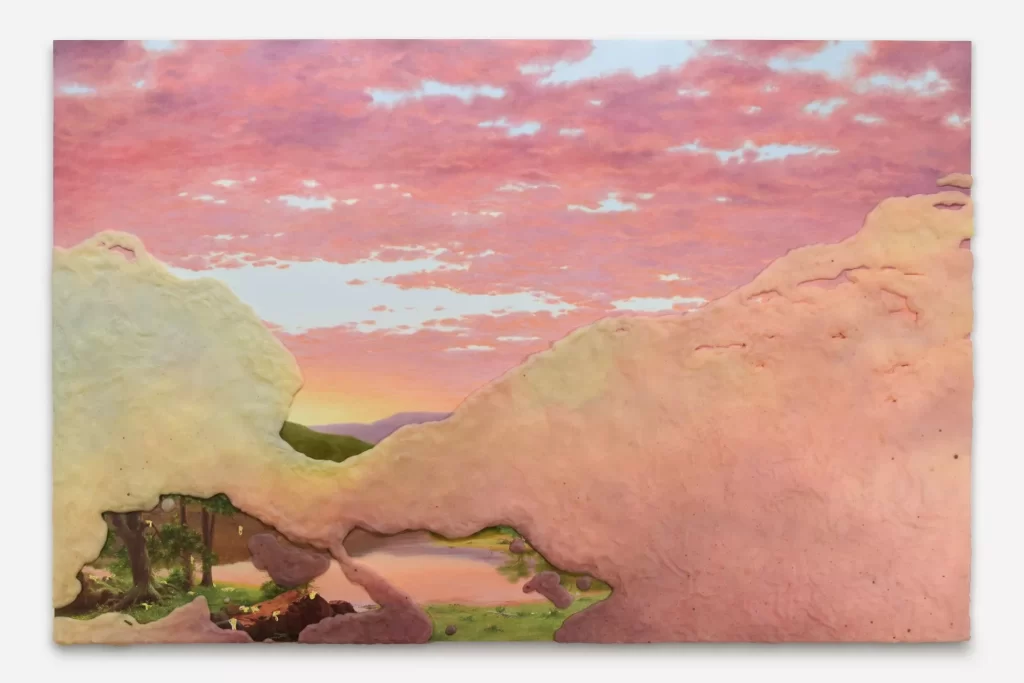

‘Christmas in California’, 2022, by Guimi You.

The Korean artist is a LUX favourite.

Image chosen by our editorial team [Lux magazine],

not an endorsement by the writer.

5. Museums will deaccession more works

The Whitney Museum of American Art recently deaccessioned seven works, including four by Edward Hopper, with proceeds from the sales said to be going to support new acquisitions. Hopper is indisputably one of America’s greatest artists and it strikes me that the action caused panic in the market – works by Hopper were predicted to take a tumble in value. This is the unfortunate side-effect of deaccessioning artworks. However, I personally feel that an artwork is far better served on an art lover’s wall than in a museum vault.

6. ESG will have a greater foothold in the market

Environmental, Social and Governance (ESG) is a framework that is rapidly gaining in importance. It is not only an indicator of the sustainable health of an economy or company, it is also driving decision-making among the new generation of collectors. Where the baby-boomer generation was interested in how an artist draws from art history, the new generation of collectors is more concerned with asking about what drives the artist. What are they trying to communicate with their work? Does it represent the zeitgeist and discuss contemporary themes, such as #MeToo, Black Lives Matter or the war in Ukraine? In trying to captivate the new generation, galleries will have to engage with ESG reporting and initiatives.

7. Expenditure in fine art as an asset will increase

I always advise to buy for passion, but with an investment view. According to cultural economist Claire McAndrew, investments in fine art are especially lucrative during inflationary and recessionary periods. I have noticed significantly increased movement over the past few months, especially on the private sales side of the market. From an eye-opening Lichtenstein to a rare Caravaggio, never have I been offered so many works for private sale and acquisition. With the impending transfer of wealth from the baby boomer to the millennial generation, I predict there will be many a marvellous work to hit the auction block in 2024 and, indeed, over the next few years.

Source: Lux Magazine